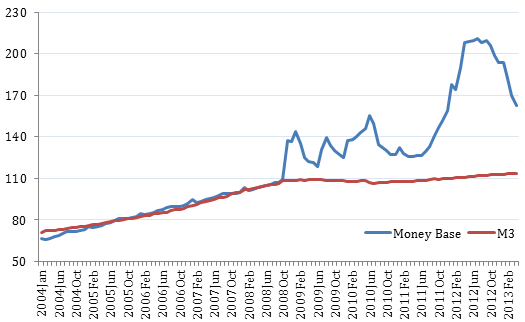

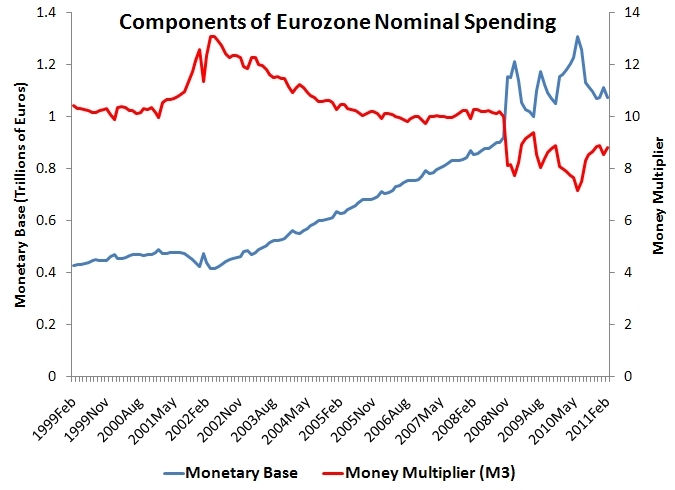

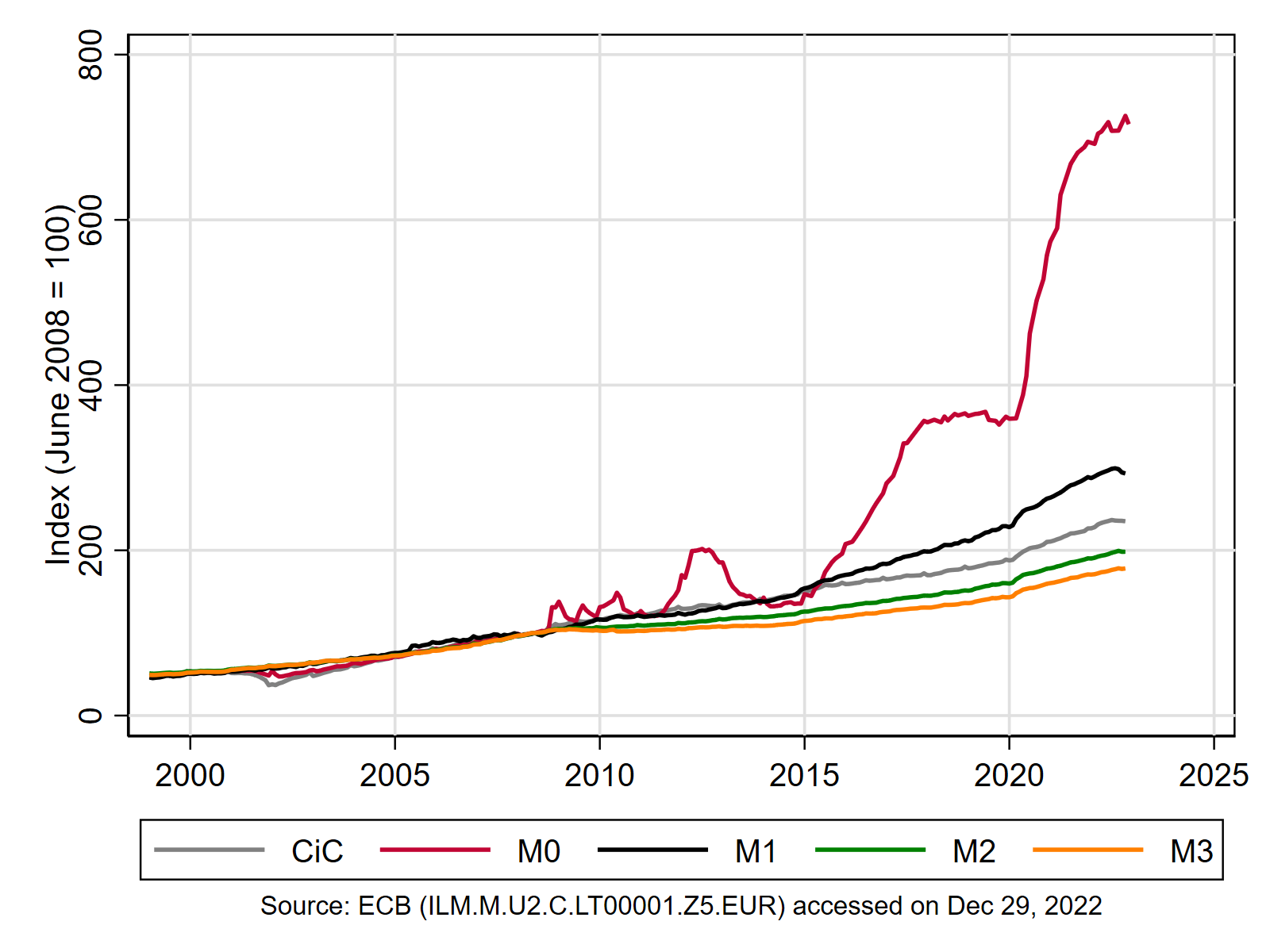

Eric Dor on Twitter: "It is often wrongly claimed that assets purchases by the #ECB massively increase the stock of #money circulating in the euro area Such a claim is a mistake. #

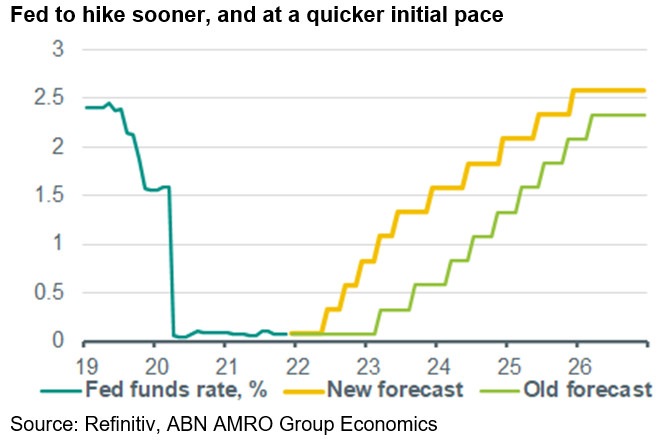

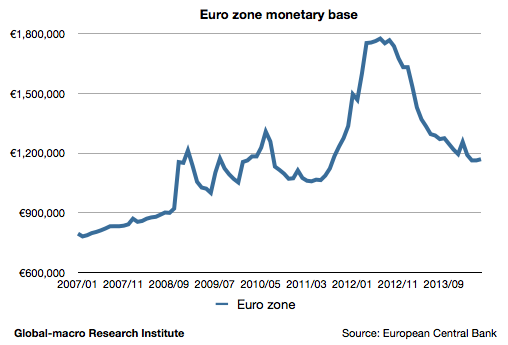

Eurozone in times of Covid-19: Debt monetisation by stealth, SUERF Policy Brief .:. SUERF - The European Money and Finance Forum

/graphics.reuters.com/EUROZONE-MARKETS/ECB/lgvdwzngepo/chart.png_2.jpg)