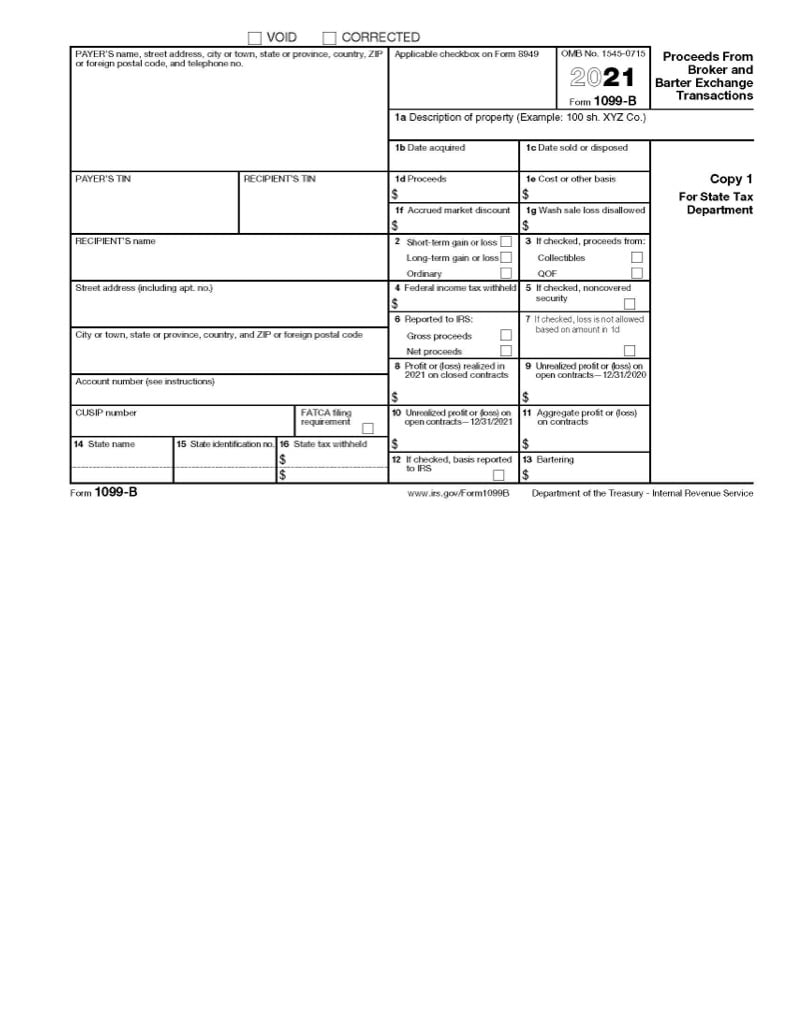

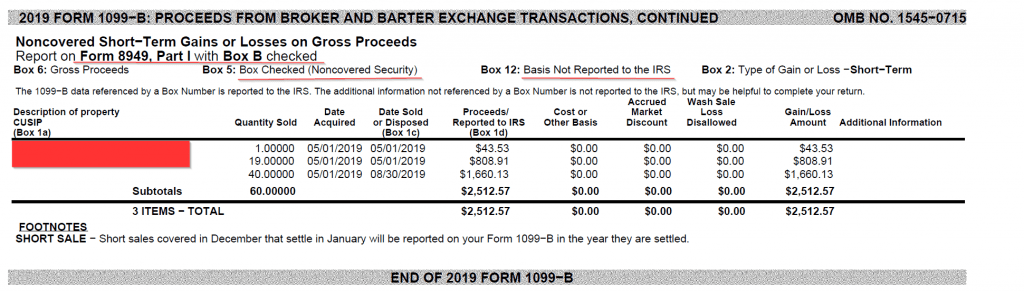

united states - What are the requirements to not report all stock transactions on the tax return 1099-B? - Personal Finance & Money Stack Exchange

The Other March Madness: How Do You Report Stock Sales On IRS Form 8949 If The Cost Basis Is Wrong On Form 1099-B? - The myStockOptions Blog

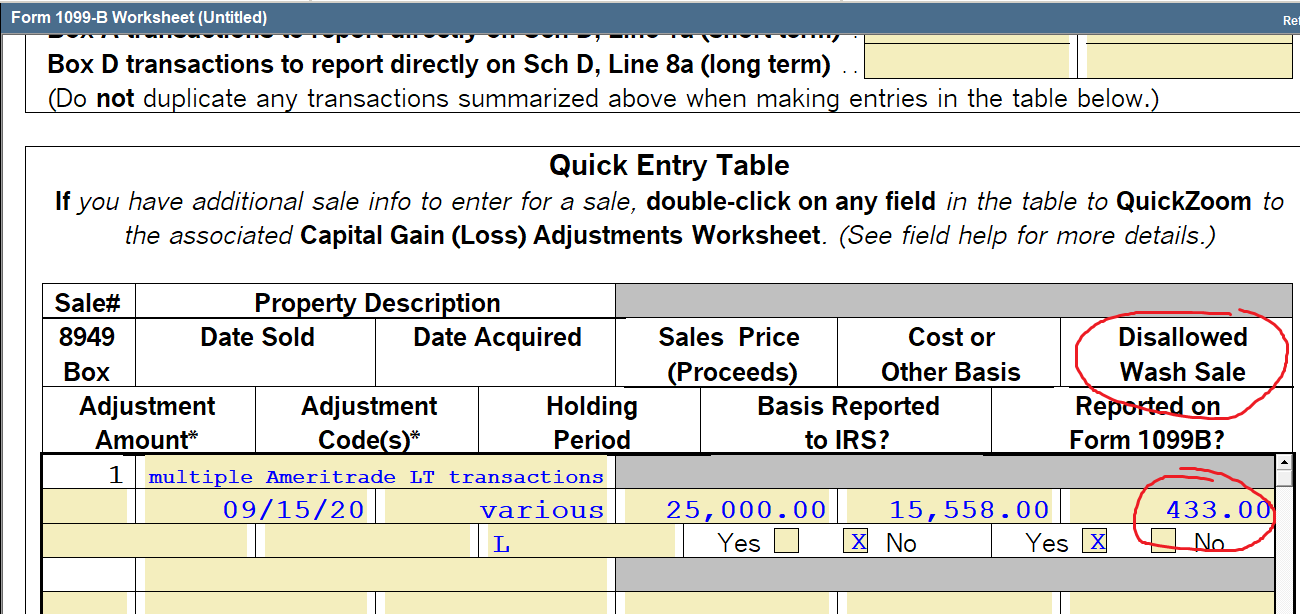

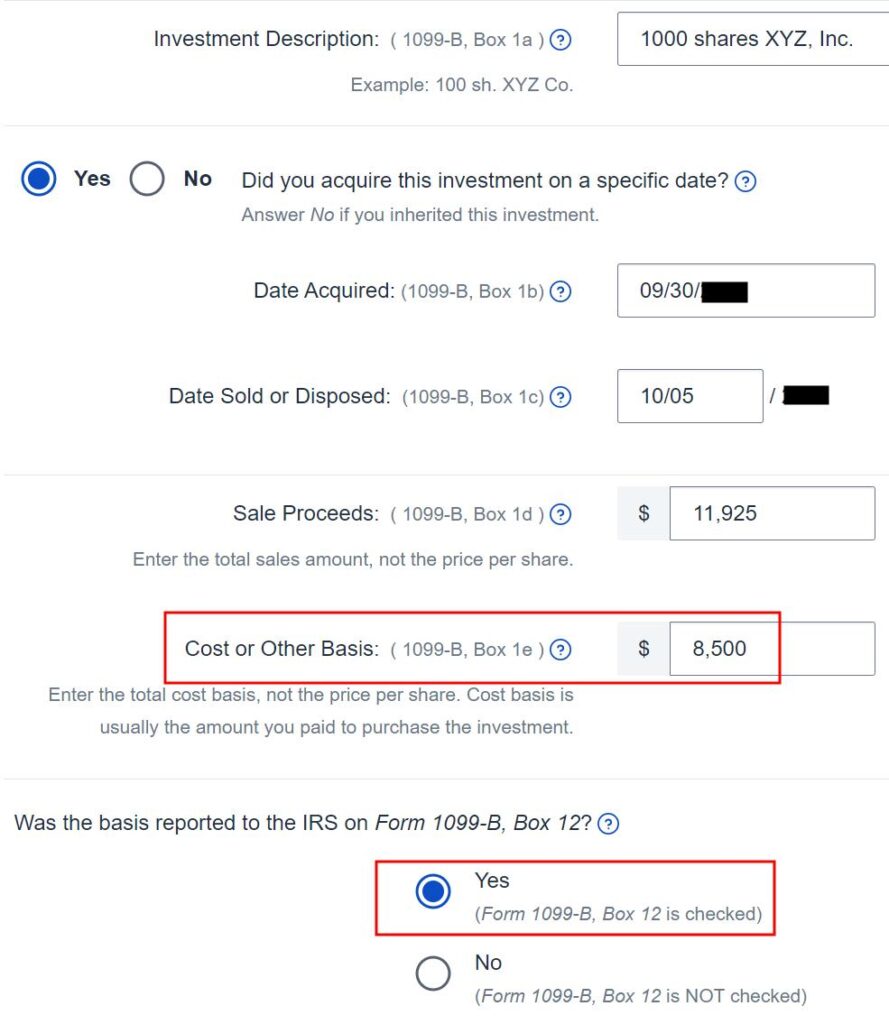

I am attaching the 1099-B but there is a Wash Sale loss disallowed and it won't let me put in the code M. - Intuit Accountants Community

The Other March Madness: How Do You Report Stock Sales On IRS Form 8949 If The Cost Basis Is Wrong On Form 1099-B? - The myStockOptions Blog

:max_bytes(150000):strip_icc()/IRSForm8949-d55e89f19d8043719e68055fdd8dad41.jpg)

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)